Education In The UK: Navigating The UK Educat

Education in the UK is known for its high quality, offe...

Transferring money from Nigeria to the UK and vice versa, is a common need for many individuals. But the thing is, finding a reliable and cost-effective money-transfer service can be overwhelming. As a result, we’ve compiled a list of money transfer services with the best rates and fees, allowing you to send money between Nigeria and the UK. Without further delay, let’s get started!

Read Also: Bridging the Gap: Understanding British Humour

Below is a list of some popular money transfer services that allow you to send and receive money between Nigeria and the UK:

Note: The list provided is an alternative means of sending and receiving money between Nigeria and the UK. They are not arranged in any specific order!

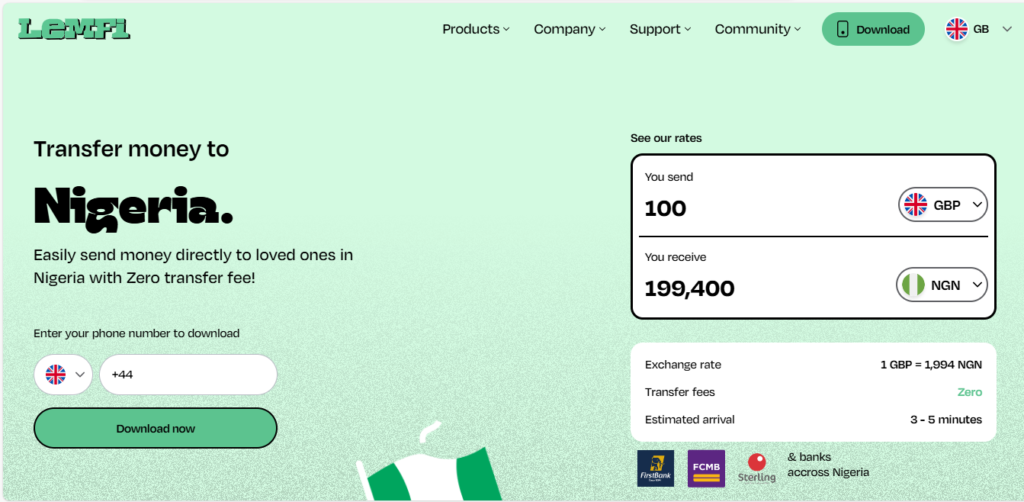

LemFi, formerly known as Lemonade Finance, is an international fintech company that allows you to do multiple transactions in different currencies. This platform allows you to send and receive money between Nigeria and the UK. One of its standout features is the ability to send and receive money internationally with zero charges.

| Pros | Cons |

| User-friendly | Poor customer service |

| Zero transfer fee | Low transaction limit |

| Currency conversion | Possible transaction delays |

| Competitive exchange rate | |

| Global reach |

Read Also: British Workplace: Know The Cultural Nuances in the UK

SendWave is a fast, easy-to-use financial technology company headquartered in Boston, M.A., in the US. The company offers money transfer services between multiple countries, including Nigeria and the UK. Its affordability, simplicity, speed and competitive exchange rate are what make it popular over other money transfer services.

| Pros | Cons |

| Fast and secure | Limited Availability |

| Low fees | Supports only debit card |

| Transparent | Mobile use only |

| Currency conversion | |

| 24/7 customer support | |

| User-friendly |

Founded in 2016, FlutterWave is an international company that provides monetary services to over 30 countries, including Nigeria and the UK. The platform stands out for its various features, which include multiple- currencies and the availability of various payment options such as cards and bank transfers.

Read Also: Important Tips To Verify Nigerian Police Report in the UK

| Pros | Cons |

| Wide range of services | High transaction fee |

| Secure and Reliable | Limited physical customer support |

| Fast transactions | Global restrictions |

| Pay bills and utilities | Slow customer service |

| Currency swapping | |

| Transparent fair pricing |

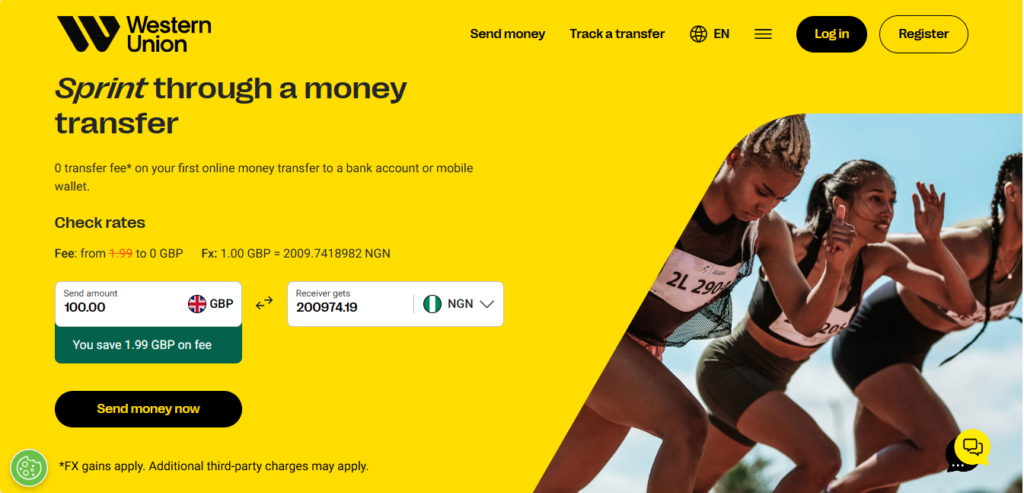

Western Union is a well-known financial company headquartered in Denver, Colorado. The company facilitates money movement to any part of the world, including Nigeria to UK money transfers. On top of this, the company also supports cross-currency money transfers, allowing recipients to receive money in different currencies.

For instance, if you want to send money to a family member in Nigeria, Western Union allows you to directly exchange British Pounds (GBP) for Nigerian Naira (NGN). This feature is akin to the listed money transfer services mentioned earlier.

Read Also: Navigating the UK Roads: Important Guide For Nigerian Driver

| Pros | Cons |

| Global reach | High transaction fee |

| Fast and secure | Exchange rate markups |

| Multiple transfer options | |

| Transparent charges |

Popular among freelancers and remote workers, GeePay is a digital financial platform that supports the transfer of money from overseas. The platform’s money transfer service is an alternative way of sending and receiving money between Nigeria and the UK. Therefore, if you want to send money to friends, family, or anybody, including employees in Nigeria, Geepay is readily available for the service. Conversely, if you want to send money to the UK from Nigeria, you need to set up a GBP GeegPay account, fund the account and begin transactions. It’s that easy!

| Pros | Cons |

| No conversion rate | Limited availability |

| Fast and secure payout | |

| Transparent | |

| Active customer support |

Read Also: Healthcare in the UK: A Beginner’s Guide

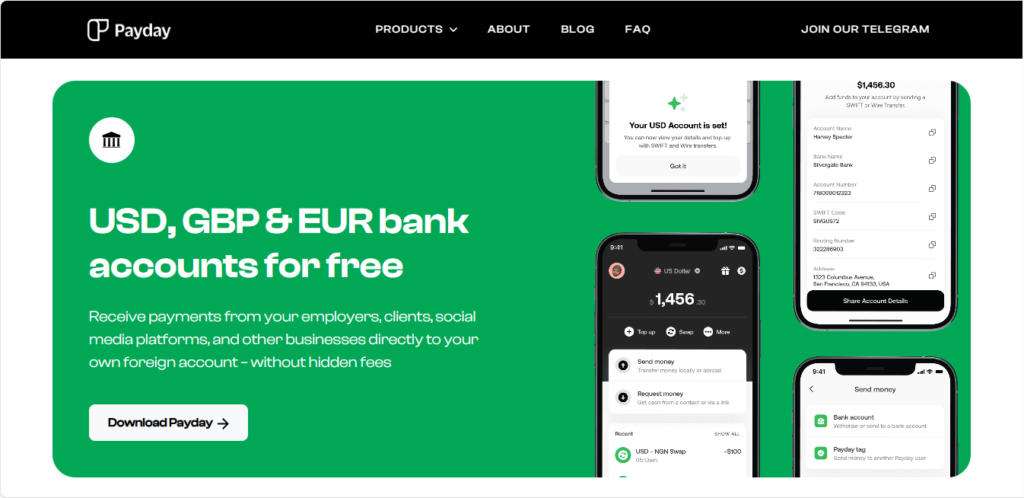

Payday offers virtual accounts in multiple currencies, including GBP and NGN, allowing you to make transactions between Nigeria and the UK. The company is a relatively new platform that began operation in 2021. With its seamless interface and efficient money transfer services, Payday emerges as one of the best Nigeria to UK money transfer services.

| Pros | Cons |

| Competitive fee | Frequent server glitches |

| 24/7 customer support | Low exchange rate |

| User-friendly interface | Limited availability |

| Fast and secure | |

| Currency conversion | |

| Support multiple currencies | |

| Wide range of financial services | |

| No hidden fee |

Grey is another financial platform that supports transactions between Nigeria and the UK. The platform was launched in 2021, providing financial solutions to residents of both Nigeria and the UK. It offers various monetary services, including multi-currency accounts, international money transfers, currency conversion and many more.

With Grey, you can seamlessly create a GBP account and initiate multiple transactions including holding, sending and receiving money in multiple currencies between Nigeria and the UK.

Read Also: Work-Life Balance: A Guide for Skilled Professionals in the UK

| Pros | Cons |

| Multi-currency account | Limited availability |

| Competitive exchange rate | Low transaction limits |

| Transparent fee | Poor customer support |

| User-friendly interface | |

| Fast and secure transactions | |

| Global reach |

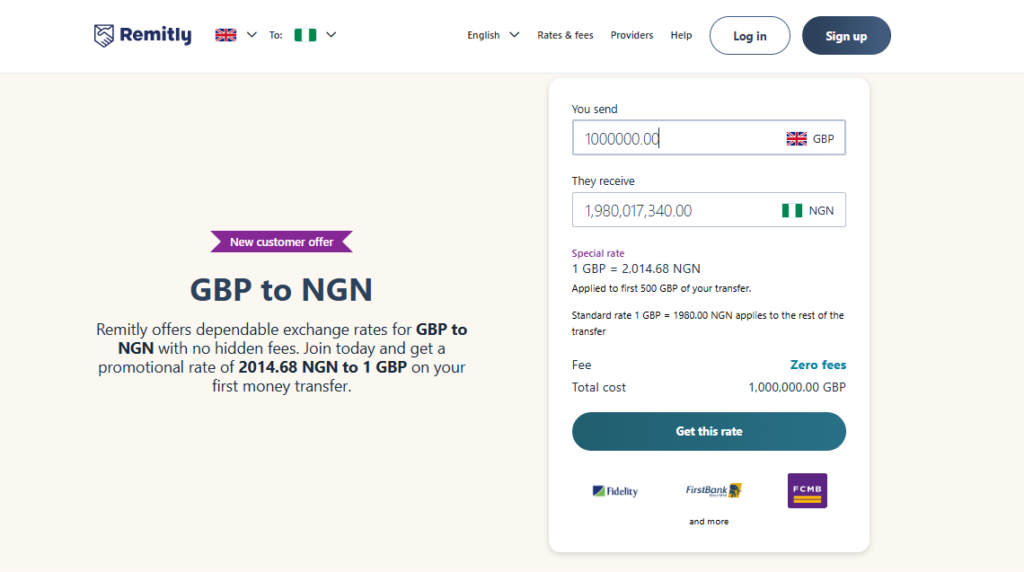

Remitly is a popular online money transfer service that makes international transactions easy. Whether you prefer bank deposits, mobile wallets, cash pickups, or even home delivery, Remitly has you covered. Based in Seattle, United States, Remitly offers services to over 150 countries all over the world.

For residents of the UK and Nigeria, Remitly provides a seamless way to send and receive money. The best part? Remitly offers money transfer services between the UK and Nigeria at competitive rates with zero transfer fees and no hidden charges. However, transactions between some countries may carry a fee, but transfers between Nigeria and the UK are fee-free.

| Pros | Cons |

| Safe and secure | Transfer fees for some countries |

| 24/7 Customer Support | Limited availability of some transfer methods |

| Fast processing time | Credit card fees |

| No hidden fees | |

| Zero transfer fees for some countries |

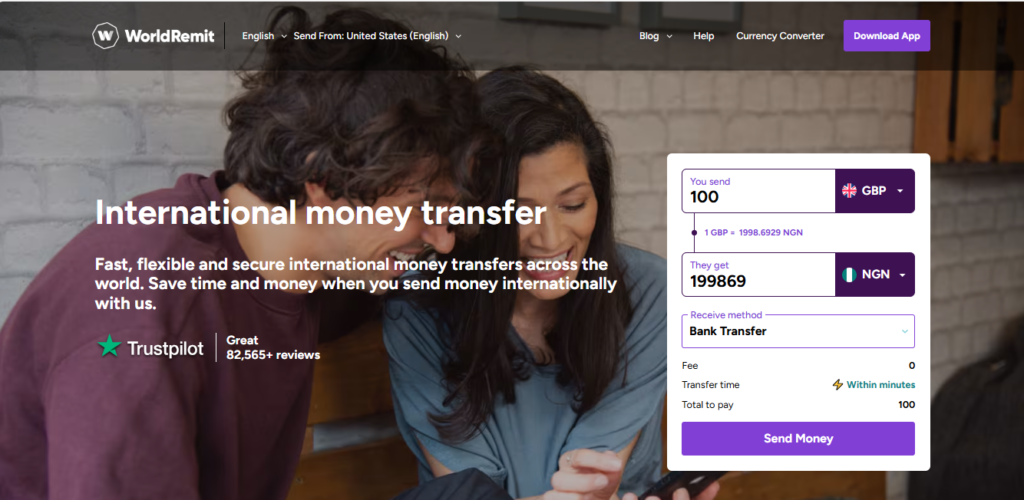

WorldRemit is a versatile, multi-currency digital money transfer that allows users to send and receive money within themselves. The platform remits money to over 150 countries across the globe, making it an alternative for sending money from the UK to Nigeria. All you need to do is sign up using your email address; verify your details, and you are ready to start initiating transfers.

| Pros | Cons |

| Multi-currency account | Not the cheapest alternative |

| No hidden fees | Some transfers may incur charges |

| Fast and secure | |

| Competitive rate | |

| Global reach | |

| Different payment options |

Read Also: Visa Rules for Skilled Worker Nigerians in the UK

| Money Transfer Service | Transfer Speed | Transfer Fees | Exchange Rate |

| Lemfi | 3 – 5 minutes | Zero | Competitive |

| SendWave | 1-3 business days | Zero | Competitive |

| FlutterWave | 1-3 business days | 3.8% | Competitive |

| Western Union | 1-2 business days | Varies (payment mode dependent) | Competitive |

| GeegPay | 1-2 business days | Zero-low | Competitive |

| Payday | 1-2 business days | Low | Competitive |

| Grey | Within 24 hours | 1% | Competitive |

| Remitly | Minutes-hours | Zero-low | Competitive |

| WorldRemit | Minutes | Zero | Competitive |

Exchange rates have an effect on the total money a recipient receives. It is determined by the foreign exchange market and fluctuates based on supply and demand. Nevertheless, here are strategic tips on how to find money transfer services with good exchange rates:

Read Also: British Workplace: Know The Cultural Nuances in the UK

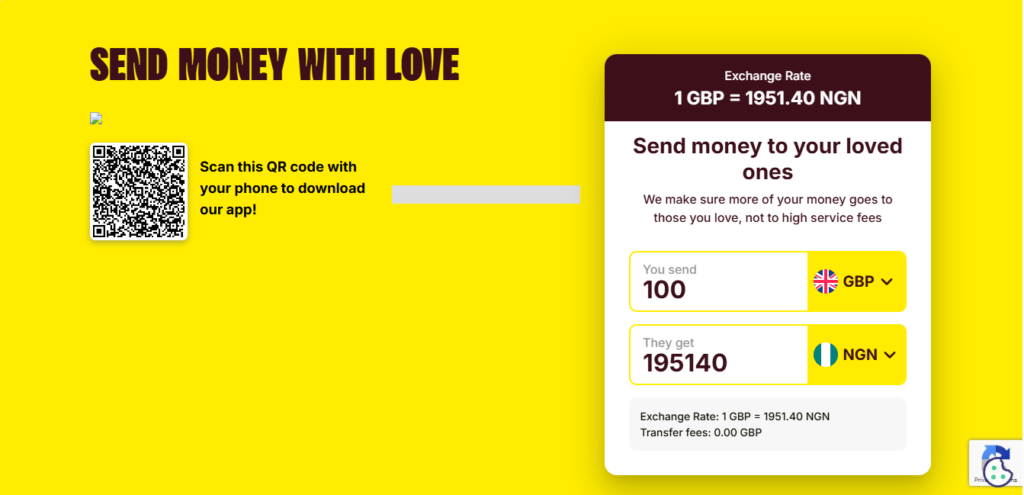

Sending and receiving money between countries is an important process that requires careful consideration and understanding. When it comes to Nigeria to UK money transfers, several services allow you to send and receive funds seamlessly between the countries. Each one has distinct characteristics, including exchange rate, transfer speed, and fees. By understanding these differences, you can make informed decisions and ensure your money reaches your destination as fast and cost-effectively as possible.